|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

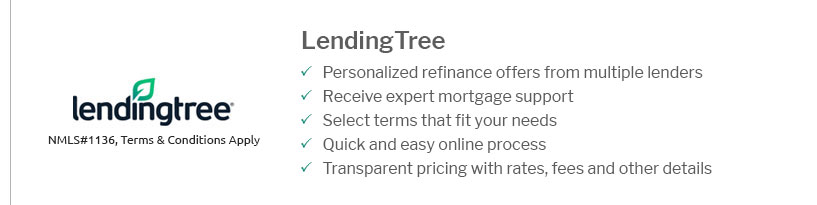

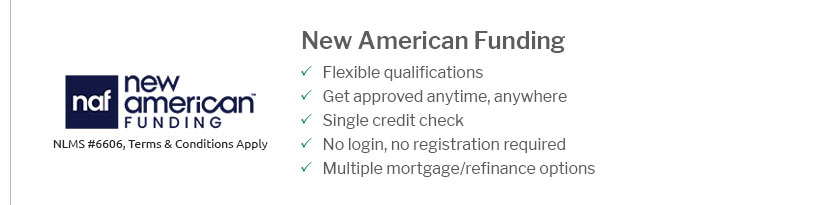

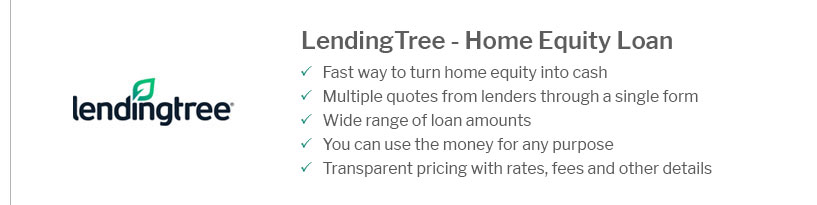

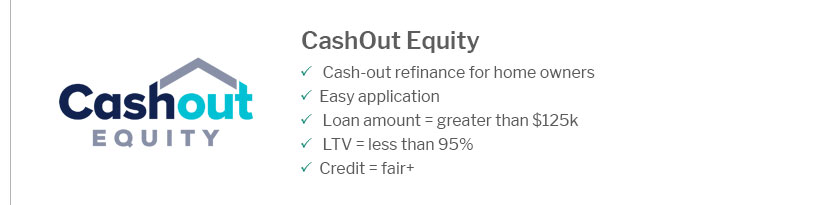

Best Rated Mortgage Lenders: Expert Tips and AdviceFinding the best rated mortgage lenders can be a daunting task, but with the right information, you can secure a mortgage that fits your financial needs. In this article, we'll explore some of the top-rated mortgage lenders, what makes them stand out, and how you can benefit from their services. Top Mortgage Lenders to ConsiderWhen choosing a mortgage lender, it's essential to look at their reputation, customer service, and the variety of products they offer. Here are some of the best rated mortgage lenders:

Factors to Consider When Choosing a Mortgage LenderInterest Rates and FeesOne of the most critical factors when choosing a mortgage lender is the interest rate they offer. Comparing rates can save you thousands of dollars over the life of your loan. Additionally, be aware of any fees associated with the loan, such as origination fees or closing costs. Loan OptionsDifferent lenders offer various loan products, so it's crucial to find a lender that provides options that fit your needs. Whether you're looking for a fixed-rate mortgage, an adjustable-rate mortgage, or a government-backed loan, ensure the lender offers what you're seeking. How to Improve Your Chances of Getting ApprovedImproving your chances of getting approved for a mortgage involves several steps. First, ensure your credit score is as high as possible. Paying off debts and avoiding new credit inquiries can help. Secondly, save for a substantial down payment, which not only increases your approval chances but might also get you a better interest rate. For further insights, you might want to explore if are harp interest rates higher to better understand rate fluctuations. Frequently Asked QuestionsWhat should I look for in a mortgage lender?Look for competitive interest rates, good customer service, and a variety of loan options. It's also beneficial to choose a lender with a strong reputation and positive reviews. How can I ensure I get the best mortgage rate?To get the best mortgage rate, maintain a high credit score, compare rates from multiple lenders, and consider opting for a shorter loan term if possible. Are online mortgage lenders reliable?Yes, many online mortgage lenders are reliable and offer competitive rates. It's crucial to read reviews and check their credentials before proceeding. For those considering refinancing, learning about the best mortgage refinance options can provide further financial benefits. Understanding the ins and outs of refinancing can help you make an informed decision. https://www.nerdwallet.com/h/reviews/mortgage-lender-reviews

Mortgage Lender Reviews ; NASB Mortgage Review 2024. 4.0 - Sample mortgage rates are customizable. ; Wells Fargo Mortgage Review 2025. 4.5 - Sample rates are shown ... https://www.reddit.com/r/FirstTimeHomeBuyer/comments/11mjqqx/what_mortgage_lender_would_you_recommend/

Mortgage brokers - these guys are pros at working deals and re-shopping till the end. They often can and will get the best deals with companies ... https://www.forbes.com/advisor/mortgages/best-mortgage-lenders/

After researching more than 50 national lenders and evaluating 16 data points in seven different categories, we found New American Funding ...

|

|---|